This piece was written by Brett Bivens and originally appeared on Medium.

In the first episode of The Footnote Podcast, I thought it would be useful to talk a bit about what I have learned in my first year on the investor side of the table after spending most of my career on the other side — helping build startups in various business and product roles — and explore the quick framework that I’ve developed around how to operate as an early stage investor.

This framework, which I call thinking slow, deciding fast informs the way I approach two of the more important aspects of my job — building conviction on a company as I am thinking about whether or not we should invest and building a relationship with the founding team during that period where we are coming to a decision.

In a lot of ways, this phrase — think slow, decide fast — is like a meditation mantra…those mantras help recenter you when you find yourself slipping and losing focus. This is essentially the same thing. If I find myself thinking or behaving in a way that contradicts this framework, I try to recenter and approach the situation from a different angle.

Second Level Thinking

The phrase that I’ve mentioned…again, thinking slow and deciding fast, likely calls to mind the book by Daniel Kahneman called Thinking, Fast and Slow. It is a great read and definitely informs the approach I have taken. The central thesis in the book is around the dichotomy between two modes of thought: “System 1” is fast, instinctive and emotional…basically lizard brain type of thought; “System 2” is slower, more deliberative, and more logical.

Another person who has latched onto the “two modes of thinking” concept is Howard Marks — an investor at a firm called Oaktree Capital. Howard has become well-known for both his outsize investment returns as well as his well-constructed investor letters…similar in a lot of ways to Warren Buffett

And, the way these two people — Kahneman and Marks — have laid out their beliefs has been very helpful for me in framing my investment strategy.

Thinking slow, the first part of the phrase, is all about building conviction on investment opportunities, which seems to be one of the toughest things about being new to investing. In my case, I went from the startup side of the equation where you are literally desperate for any opportunity that comes your way to the investor side, where I may look at 300 companies before our firms makes a single investment. So because you are drinking from this kind of fire hose early on in your investment career, people tend to fall back on these very surface level indicators to make decisions:

- Oh, Bla Bla Bla Capital is investing, they are really smart so I can’t miss out on this deal

- Oh, the team went to some prestigious school so I should be impressed by them by default

- Or, oh this is the hot new technology area that everyone is talking about, we have to be active in this space

Of course, these are all important elements of making an investment decision — you want to work with a team who has the chops to pull off what they say they are going to do, you want to have other smart, committed partners in the business, and you want to be investing in technology areas or markets where there is significant opportunity.

But thinking slow is about not taking these things simply at face value. It means:

- Employing something like the Toyota Five Whys framework — a series of 5 questions, each building off the last and delving further into the problem.

- Or, as Marks notes, exercising caution if you are operating in a space that everyone else likes…a “hot” area so to speak…if tons of capital has already poured into a segment of the market, it is possible that it is already thoroughly mined and that prices/valuations likely reflect the “hotness” of the vertical.

- And finally, understanding the incentives of your potential partners — just because some super smart investment firm is involved in a deal doesn’t mean you should be by default…their portfolio is constructed differently, their strategy is different, they may be more or less sensitive to valuations, etc.

So that has been my approach on the actual investment decision side of things, on how I build conviction on an investment opportunity.

Deciding Fast

Another important piece of my work as an investor is on building and maintaining strong relationships with the founders and teams we are working with. And this is where the “deciding fast” part of the phrase comes in…it doesn’t really have much to do with the Kahneman and Marks System I / System II stuff but it helps make the title sound more interesting.

A friend of mine who is also an early stage VC said over dinner the other day that by the time they get to the point where they want to build a financial model or do some kind of in depth returns analysis on an individual deal, it is a strong signal that they want to invest…at the seed stage, and even in some cases at the A stage, there is a limited amount of quantitative work you can do. So in most cases, they just make the decision then and there. And that is exactly what this idea gets at.

Having been on the other side of the table for most of my career, I know that startups don’t have much leverage in any of the conversations they have — customers can squeeze them on pricing, potential job candidates have offers from other companies with better compensation, and investors often have a bit more leverage in negotiations…in many cases, decisions get made wholly on the investor’s time table.

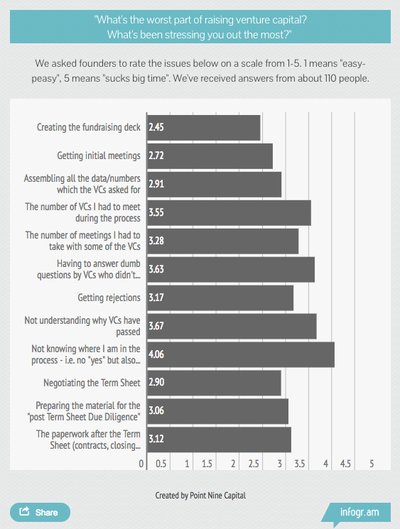

There was a survey done a couple of years ago by Point Nine Capital’s Christoph Janz that found the #1 most frustrating thing for founders about fundraising was not knowing where they stood in the process.

So one of the big things I try to do is make sure that whenever I make a decision or get some type of “news” on a company — whether it is a decision to move them forward in the process, to say no, to present what they are doing to the broader team, or if thereis some kind of delay — is make sure I communicate that clearly and in a timely fashion to the founders.

So there you have it…my 1-year in framework for trying to do my job as a venture investor well:

Build conviction by trying to think deeply about the levers that truly have an impact, know when you have enough information, make your decision, and clearly communicate that to the people you are dealing with.

Sounds simple but in my experience has been anything but.

The Footnote is a series of audio annotations on some of the interesting things I’ve come across recently on a wide range of topics — from decision-making and investing to technology and the impact it has on the way we work and live.

These episodes are a semi-dive deep into something I’ve written, a topic I want to write about, an interesting article or piece of research, or a recent idea I’ve been kicking around. In each installment, we’ll aim to pull on different threads and explore new angles to help better understand the concepts presented and more thoroughly develop our thinking on the subject at hand.

You can subscribe to The Footnote over on Bumpers >>>