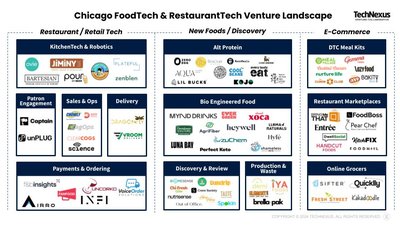

TechNexus Venture Collaborative is tracking over 85 early stage ventures in Chicago disrupting the food and restaurant industry that have raised over $350 million in cumulative funding. A wide array of disruptive companies stand out in this space, including bio-engineered foods, customer engagement/reward platforms, and customizable DTC meal kits.

Chicago's history is deeply intertwined with being a food city. In the 19th century Chicago's role as a transportation hub led it to be the largest meatpacking center in the country, establishing it as the "hog butcher to the world." This led to the rise of iconic meat companies like Armour & Company and Swift & Company, which pioneered innovative methods of meatpacking and distribution. The city's location also made it a central point for the grain trade, attracting companies like Quaker Oats and Kraft Foods. These companies not only shaped Chicago's history, but also contributed significantly to the development of the modern food industry.

Today, several large food and CPG companies either call Chicago home or have a large presence here. These include Conagra, Kraft Heinz, Mondelēz, Mars Wrigley, Treehouse Foods, Ferrara Candy, PepsiCo, and many others.

Chicago is also home to a thriving community of renowned chefs and innovative restaurants, pushing culinary boundaries and attracting national recognition. Chicago plays host to the renowned James Beard Foundation Awards, hosted annually at the Civic Opera Building (also home to TeamWorking, the largest coworking space in Chicago).

The city's food scene is further enriched by a new generation of food companies and startups. Companies like RXBar and Farmer's Fridge are redefining snacking and convenience foods, while others like Tovala and Home Chef are changing the way people cook and eat at home.

Chicago's legacy as a food city is not just about its famous dishes or its innovative companies. It's about the people who built the industry, from the stockyard workers to the entrepreneurs who created iconic brands. This rich history continues to shape Chicago's food culture today, making it a dynamic and exciting place for food lovers and innovators alike.

Areas TN is excited about:

Discovery and Review: 85% of diners look up the menu online before deciding on a new restaurant, underscoring an increasingly digital food experience. As discovery and broader food education continues to migrate online, ventures are transforming how individuals find and engage with food and beverage. From curated restaurant recommendations and allergy-friendly resources to personalized nutrition insights and gamified cooking tools, companies are emphasizing convenience, personalization, and community-building, capturing trends in health-consciousness, sustainability, and tech-enabled lifestyle solutions.

- Zest App (Undisclosed Round in ‘23): A skills based at-home cooking app, Zest integrates gamification into cooking, supporting users from grocery shopping to step-by-step recipe guidance.

- Out of Office ($1.3M Round): This social platform facilitates trip planning and experience sharing, allowing users to discover and share their favorite restaurants and vacation spots.

Alternative Proteins/Bio-engineered Food: The NIH projects the alternative proteins market to grow from 13 million metric tons in 2023 to 97 million metric tons by 2035, reaching a global market value of $290 billion. With environmental concerns, lower price premiums, animal welfare, and an increased focus on personal health culturally, this vertical is primed for growth. From algae-based proteins to cultivated meat and plant-based seafood, ventures are incorporating fermentation, cellular agriculture, and bioinformatics to create sustainable, cruelty-free alternatives to traditional animal products.

- Aqua Cultured Foods ($7 million Round): Produces fungi-based food products that mimic the taste, texture, and freshness of traditional seafood.

- Land Lovers ($450,000 Round): Founder and food scientist Dr. Huan Xia, PHD, has developed a plant-based steak substitute with half the calories and zero cholesterol.

- Hyfe ($11 million Round): Refining plant waste through fungal fermentation to create the cheapest and lowest carbon intensity sugar.

Sales & Operations Tech: According to the National Restaurant Association, 98% of operators say high labor costs are an issue, and 38% say their restaurants were not profitable in 2023. Tools such as AI-driven forecasting, order processing automation, and centralized management platforms are enabling restaurants to streamline workflows, reduce operational costs, and improve customer experiences.

- Clearcogs (Undisclosed Round ‘24): Provides AI ops and reporting solutions for restaurants for forecasting of food prep, labor, and menu item profitability.

- Chowly (Undisclosed Round ‘24): An off-premise platform that empowers restaurants to create, capture, and convert demand into sustainable profits via digital marketing, online ordering, smart pricing, and more.