This piece originally appeared in our Top 10 in Tech: Chicago newsletter. To receive this email every other week, subscribe here.

Welcome back to the latest edition of the Top 10 in Tech. I'm Jim Dallke, TechNexus' Director of Communications, and today we’re talking predictions and big ideas for 2025.

Turning the calendar to a new year is a time to think ahead, and think big. So I asked the TechNexus team to provide some predictions for the tech industry, corporate innovation and Chicago for the year ahead. Here’s what they had to say:

Startup Consolidation

“With the changes in the business environment and an evolution of the technology industry, 2025 will be a year in which we witness significant consolidation in the industries. Expect to see many Chicago based companies be acquired to form more comprehensive solutions and with it a freeing of talent to build anew in the years that follow.” — Fred Hoch, TechNexus Founder and General Partner.

The Rise of Hybrid Funds in 2025

"In 2025, hybrid funds will continue to reshape venture investing -- blending venture capital's 'growth at all costs' mindset with private equity’s operational playbook. Startups won’t just get funding; they’ll gain hands-on operational support to optimize everything from supply chains to sales strategies. Legacy firms like Sequoia and Andreessen Horowitz have been moving in this direction, but 2025 will mark a tipping point -- the widespread embrace of operational expertise as a core investment strategy.

“With Chicago as a hub for logistics and healthtech -- industries where scaling requires more than just capital -- a legacy Chicago VC firm will lead the charge, staking its claim in this hybrid territory and setting a new standard for Midwest venture investing.” — Matt Meyers, Director of Strategy.

High Interest Rates Remain a Challenge for Startups

“Interest rates will remain sticky and high for most of 2025, so debt products and venture debt will remain an expensive option for startups. Despite rate cuts and positive inflationary news, the bond markets expect Trump proposed tax cuts and deficit increases to have negative impacts on inflation.” —Andrew Loulousis, VP of Strategy and Venturing.

Hybrid Workplaces Will Become the New Norm

“The hybrid office model will be fully integrated into the coworking ecosystem. With more companies embracing flexible and remote policies, the demand for adaptable coworking environments will increase. The real value lies in the community, collaboration, and connections fostered among neighbors in shared spaces. That value alone will be highly influential in drawing more people back to in-person work.” — Taylor Kinsella, Director of Operations

Chicago to Double Down on HardTech

“I predict the Chicago venture landscape will see an increase in HardTech deals in 2025. Illinois has become a national hub for quantum computing, biotech, and infrastructure technologies with an influx of federal and state funding which will enhance venture innovation and deal flow within the state and city. With startups like NanoGraf, Natrion, and Mattiq, and innovation hubs like mHub and Portal Innovations, the ecosystem is equipped to grow and scale these ventures into production.” — Ellie Davis, Senior Manager of venture impact

Defense Tech’s Momentum Will Accelerate in 2025

“A once niche and 'off-limits' investment category, defense tech is becoming increasingly popular in the venture world. Driven by global conflicts, a shifting political landscape, and a growing willingness among venture investors to engage in the space, funding for defense tech surged to an all-time high of $3B in 2024, a tenfold increase from $300M in 2019. With continued geopolitical instability, a new administration that is expected to increase defense budgets, and blue chip firms like A16Z, 8VC, and Founders Fund doubling down on the sector, 2025 is primed to set new records for investment in defense innovation.” — Joey Alfieri, venture analyst

Geopolitical Tensions Driving Investment in Defense Tech and Infrastructure

"In 2025, rising geopolitical tensions are driving countries to increase investments in both defense and infrastructure. It’s no longer just about military technology—governments and companies are prioritizing efforts to reinforce energy grids, strengthen supply chains, and secure communication networks. The U.S. DoD alone has proposed a staggering $850B budget, with the EU following closely behind with an ambitious €500 billion investment plan. A significant portion of this spending is directed toward strengthening industrial capacity (Industry 4.0), ensuring nations remain secure and self-sufficient in an increasingly volatile global environment." — Indira Gallo, Director of Finance

Wellness-Driven Community Building to Combat Loneliness and Shape Healthier Cultures

“In 2025, the intersection of healthtech, community building, and corporate culture will drive a major shift in Chicago’s innovation landscape. As loneliness continues to emerge as a public health challenge, companies will prioritize building meaningful in-person and virtual communities to foster connection among employees. This trend will be accelerated by a cultural shift toward healthier lifestyles, influenced by the popularity of health technologies and interventions like Ozempic.

“We’ll see corporate wellness programs and coworking spaces evolve into hubs for shared activity, such as walking meetings, wellness challenges, and collaborative fitness initiatives. These programs won’t just target physical health—they’ll address emotional well-being and belonging, positioning community as a core driver of productivity and retention. Chicago, with its rich network of healthtech startups and Fortune 500 companies, is primed to lead this movement by integrating wellness-focused community building into corporate innovation strategies.” — Erin Martell, Director of Venturing

The Afternoon Flow: More Networking Opportunities for Chicago's 'Sober Curious'

“In 2025, let’s see Chicago redefine business networking with a new daypart: Afternoon Flow—a time to connect over spirit-free cocktails and meaningful conversations. Between 3–6 PM on weekdays, it bridges coffee-fueled mornings and traditional post-work happy hours, offering a refreshing way to meet up over sophisticated, non-alcoholic options. With the rise of sober-curious lifestyles, a growing focus on wellness, and rapid innovation in the NA space (shoutout to Chicago’s own Go Brewing), Afternoon Flow is poised to become the go-to networking happy hour—building community and fostering connections, one zero-proof drink at a time in a city where innovation flows, with or without the buzz.” — Maddy Rutter, Sr. Director of Collaboration

Trade Wars with China Will Lead Entrepreneurs and Large Corporations Towards Securing Supplies of, or Innovating Away From, At-risk Critical Minerals

"China announced in December of 2024 that it would ban the export of certain critical minerals to the United States. Included in this list were gallium (nearly 99% of global supply produced by China), germanium (59%), and antimony (47%). These minerals are critical to national security and production capacity, being commonly used in semiconductors for automotive and defense manufacturing. We saw in 2020 what semiconductor supply chain disruptions would do to our economy, and we’ve known how risky reliance on Taiwanese semiconductors is. With no sign of tensions being eased, who will step up?” — Nathan Musso, Sr. Venture Analyst

And now, onto this week's Top 10....

1. Reinventing Industry: Introducing our early-stage Chicago startup tracker

We at TechNexus are excited to introduce a our directory of more than 1,000 early-stage Chicago startups. Part of our Reinventing Industry series, this consolidated resource spotlights the biggest industries seeing venture activity in Chicago, and the top early-stage startups disrupting each vertical. We also share some of our thoughts on trends and sub-verticals we are excited about.

This page serves as a hub for everything we’ve been tracking across industries, featuring a curated list of early-stage startups broken down by category, detailed market maps, and articles exploring the ventures redefining their sectors. This page will be a living, breathing resource that will be continuously updated as we add companies and new category breakdowns. Dive into the full list here and bookmark this page as we update with new market maps and early-stage startups.

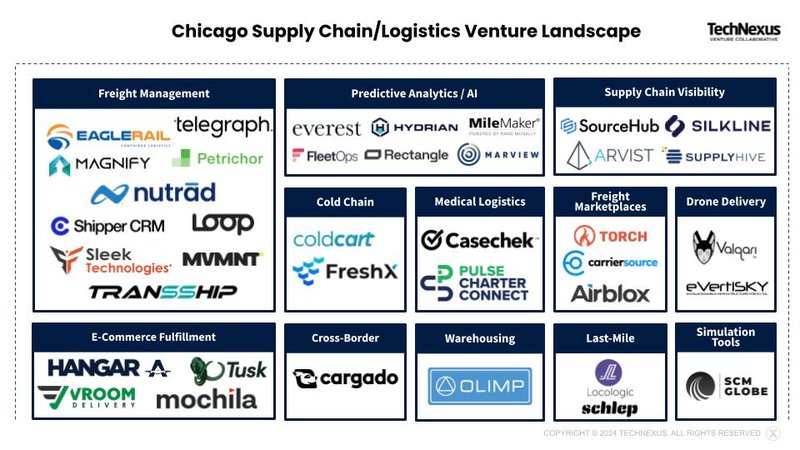

2. Mapping Chicago's Supply Chain and Logistics Venture Landscape

Speaking of our Reinventing Industry series, we’ve published our latest market map on the logistics and supply chain venture landscape in Chicago. Chicago has been a cornerstone of logistics and transportation in the U.S. since the Civil War. Its strategic centralized location, access to navigable waterways, and expansive interstate highway system have established it as a pivotal hub for the movement of goods. Today, nearly 40 innovative ventures, ranging from freight management to last-mile delivery and drone logistics, are transforming traditional supply chains while securing significant venture capital to propel their cutting-edge technologies forward.

3.A Major Chicago Tech Acquisition

Chicago startup Simple Mills, a maker of healthy baking mixes, crackers, cookies and snack bars, was acquired by Flowers Foods for $795M. Founded by Katlin Smith in 2012, Simple Mills won the University of Chicago’s New Venture Challenge startup competition in 2014.

4. Where Chicago Ranks for VC Funding

Chicago raised the 10th most funding of any city in 2024, according to cap table management platform Carta. Chicago startups on Carta raised $766M last year, which fell behind startup ecosystems like Austin, Seattle, Denver/Boulder, San Diego and Washington, D.C. While not a complete report on total venture funding, the report shows how Chicago still falls behind other emerging tech hubs for startup capital. One interesting note: Chicago was fourth in the country for funding to fintech and consumer startups, according to Carta.

5. Major Milestones from the TechNexus Portfolio

It’s been a fast start to 2025 here at TechNexus. Our portfolio company Caramel, a startup that's changing the way people buy and sell vehicles online, has agreed to be acquired by eBay. Meanwhile, Harbinger, another TechNexus portfolio company, raised $100M in a Series B to scale production of its medium-duty electric trucks. Harbinger is building hybrid RVs for THOR Industries, the world’s largest RV maker and one of TechNexus’ corporate partners.

- Related Read: See how TeamWorking member Sage Clarity grew to help Walmart, Tito's Vodka and more brands transform their manufacturing

6. Tesla Lands Funding for Electric Truck Charging Corridor in Illinois

Tesla won part of $100M in funding to build electric truck charging stations across Illinois, according to TechCrunch. The award, given out by the Biden administration’s Federal Highway Administration (FHWA) as part of the Charging and Fueling Infrastructure Program, will help Illinois add 345 charging ports and vehicle stalls across 14 sites.

7. Upcoming Events

- Wednesday, Jan. 22: AI and Robotics in Manufacturing: Opportunities, Challenges, and Next Steps

- Wednesday, Jan. 22: Chicago Meetup with Health Tech Nerds

- Wednesday, Jan. 22: Downtown Chicago Tech + Startups Social

- Thursday, Jan. 23: BioTech Fermenter: Chicago's Biotechnology Meetup

8. AI Home Security Startup Raises $10M

Ubiety Technologies, an AI home security startup, raised $10M in Series A-1 financing. The startup uses artificial intelligence to sense, categorize and identify people based on the devices they're carrying.

9. Social media influencer startup sells for $250M

Mavely, a Chicago startup that connects social media influencers with brands, was acquired for $250M. It has matched creators with brands like as Nike, Anthropologie, Lululemon, and Macy's.

10. New P33 Leaders

P33, the local nonprofit that aims to promote Chicago's tech sector, named two local tech leaders to its board: Kristi Ross and Jai Shekhawat. Ross is the co-founder of Tastytrade, which sold for $1 billion in 2021. She also launched her own coffee brand and shop U3 Coffee in 2023. Shekhawat is the founder and former CEO of Fieldglass, which was acquired by SAP.